Featured Speaker at Innovate 2017

Thomas Peff has implemented business change and driven growth at both early and late stage companies in a variety of financial, operational and principal investment roles. He currently serves as Director of Finance at Adaptive Insights, a high-growth enterprise software company. Prior to Adaptive Insights, he held roles as an investment professional at TDR Capital, a London-based PE firm, a CFO at a technology startup and an investment banker at Deutsche Bank. Tom graduated from Princeton University with an AB in Economics/Finance.

Tom’s session at Innovate 2017 will highlight best practices for effective budgeting, forecasting and reporting. He will share some of the internal models and processes his team has implemented to help their company better manage their business, including improved top-line forecasting, headcount & expense planning as well as automated data integration and KPI/board reporting. We sat down with Tom before his session to learn more about what attendees can expect from his presentation.

Q: Could you tell me a little about yourself and what you do?

A: I Work at Adaptive Insights. We’re a software company that provides budgeting and forecasting tools for finance departments to better manage their business. I’ve had the opportunity to work with nonprofit finance teams through our partnership with JMT. We help organizations get financial models up and running with our application, Adaptive.

Many nonprofits we help face a common challenge: They start out doing financial reporting in Excel, but slowly get overwhelmed as their organization grows in size and scale. The exercise of sending out an excel document to multiple different employees tends to get messy. Our application, Adaptive, allows people to collaborate on these projects easily. We help nonprofits develop a plan, establish targets, define a budget and start reporting accurately on their metrics so everyone is on the same page. Ultimately, we use Adaptive to help organizations become more efficient so they can spend more time focusing on where they’re headed next.

When I’m not working I try and play as much soccer as my wife will allow.

Q: What type of events do you typically do? What do you enjoy about your role?

A: I do a lot of local events for finance teams across various industries. In fact, I recently did a similar presentation for a dental association a few weeks back.

One of the great things about my job is that I can provide information that’s useful to a variety of different organizations. Finance as a function is transferable — it’s math. And a lot of the challenges companies face are fundamentally the same. It’s been great to be able to work with finance managers from different industries, hear their hot button issues, and take different approaches to problem solving.

Q: Can you give a top level overview of your session?

A: I’m going to talk through financial modeling at Adaptive and highlight prominent themes and challenges that are prevalent in all companies. I’ll be talking about how to structure models so that department heads can take ownership of their department’s finances and I’ll be providing examples of what that looks like in Adaptive. All organizations have to do reporting and tracking. My session will show people how to make their reporting more efficient.

Q: What is the primary goal for your Innovate session?

A: I want to inspire people to transform their nonprofit with financial management. My goal is for attendees to understand exactly what that transformation can look like. I want to spread the message of what Adaptive can do for finance teams.

Q: Why should attendees join your session?

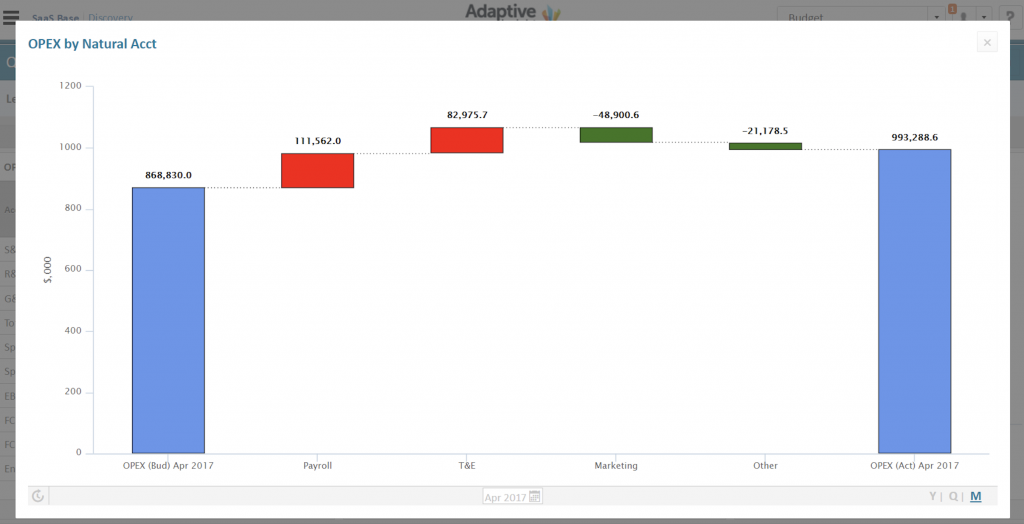

A: Waterfall charts. That may not mean much to you now, but it will. All finance departments report and explain variance in their business. I’m going to show attendees how they can use Adaptive’s tools to explain variance accurately and easily.

Q: What is the biggest financial management challenge you see nonprofits face?

A: How to do more with less. You have to be efficient. It’s important for nonprofits to be able to automate as many parts of their employees’ day jobs as possible. Finance teams are often forced to spend a lot of time formatting decks or typing numbers into excel. It’s important for nonprofits to carefully consider how they’re setting themselves up from a systems perspective. You can make your job and life a whole lot better.

Q: What do you hope the biggest takeaway is for attendees at your presentation?

A: Set up systems to help you be more efficient. I hope attendees learn ways to set up their systems in a more efficient manner and become excited about making changes in their business. These changes always take some initial work, but it’s important for people to recognize that the initial work can really pay off in the long run.

Q: Do you have a quick financial management tip that nonprofits could benefit from when reading this post?

A: My biggest tip is for organizations to make it as easy as possible to create, track, and manage their piece of the business for their end users. I also have a few helpful resources to check out before attending my presentation.

An Adaptive case studies for nonprofits.

A snapshot of a waterfall chart developed in Adaptive (helpful for finance teams explaining variance).

We’d like to thank Thomas for giving us some of his time for the interview and we hope to see you at Innovate 2017!

Innovate is JMT’s Thought Leadership and Training Conference, specifically for nonprofits.