The information in this post was originally shared by Terry Gren (Sr. Channel Manager, AvidXchange) in the on-demand video, 5 Tips to Make Financial Forecasting More Efficient with AvidXchange. A JMT Consulting software solution partner, AvidXchange is an AP automation tool for nonprofits that want to streamline their AP process, improve workflow, increase visibility, optimize invoice storage and security, and leverage real-time reports.

Financial forecasting plays a pivotal role in positioning your organization for growth and sustainability — and it’s become an even bigger priority for many nonprofits navigating today’s volatile landscape.

But forecasting is no simple task, nor is it an exact science. How can you ensure your finance team consistently delivers forecasts your organization can count on?

Read on to learn why financial forecasting is critical to long-term success, common challenges facing financial planning and analysis teams, and 5 tips for creating better forecasts.

Why Financial Forecasting Is Critical to Long-Term Success

- Avoid unanticipated cash flow shortages

- Confirm confidence in your financial position

- Influence budgets and establish business goals that are both realistic and feasible

- Ensure that difficult management decisions are built upon solid financial figures

- Provide real-time benchmarking for the growth and financial health of your organization

Common Challenges FP&A Teams Face

- Elements of the core business consistently evolving

- Identifying and accounting for external factors outside of your control

- Constant pressure to improve performance while reducing processing costs

- The amount of time required to develop a meaningful forecast

- Manual processes and disparate systems make data retrieval difficult

- Disconnect from core business units leads to lack of insight into key drivers

5 Tips for Building Better Forecasts

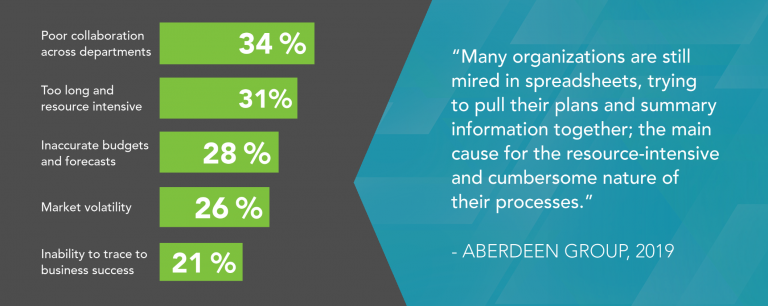

According to a study done by Aberdeen Group in 2019, many organizations are still using spreadsheets to put forecasting plans together. 34 percent of respondents shared that poor communication, coordination, and collaboration across departments was a challenge for financial planning and analysis, while another 31 percent claimed the process was too long and resource intensive.

To help you develop more efficient and accurate forecasts in any circumstance, follow these 5 actionable steps:

- Make it collaborative. You need to include all the departments that are involved in the forecast, rather than relying on one department for the entire process.

- Identify and minimize assumptions. Any forecast requires that you make assumptions about things that are outside of your control, but the best forecast limits our assumptions about external factors while clearly identifying those that must be included. Common assumptions concern market expansion, competitors, technological changes, and overall business health.

- Forecast for multiple scenarios. To maintain flexibility in your strategic planning and create more realistic expectations, you should forecast for at least two scenarios – optimistic and cautious.

- Reforecast often. Implement rolling forecasts and budgets and update them on a quarterly basis.

- Automate operational components as much as possible. Build a scalable financial system from the ground up by eliminating unnecessary manual tasks in processes such as sending and receiving payments, tracking down data from across the organization, and building custom reports.

Watch this on-demand video to take a deeper look at these 5 steps and learn how AP automation can help improve the efficiency and accuracy of your forecasting efforts!