Contents

Introduction

The modern nonprofit finance leader’s balancing act

Nonprofit financial leaders today balance the need to manage an increasing level of organizational complexity with the need for speed. You’re expected to keep your eye on multiple donors and funding sources with changing regulatory requirements and an increased demand for program services. Think that’s complicated? Now add frequent change to the equation. A monthly financial check-in isn’t good enough for today’s nonprofit finance leader. You need the agility to make decisions at a moment’s notice—and those decisions must be based on the real-time financial truth.

Here’s the question. In today’s complicated climate, is your accounting software helping you grow and achieve your mission—or holding you back? This guide will help you understand whether it’s time to make a move. You’ll discover:

- Why most financial software systems hinder your ability to get good financial information

- The six key questions you need to ask before considering a move to a cloud-based financial solution

- Why the process for evaluating software is different for cloud solutions

Challenge

Why is it so hard to get good financial information?

It’s not you, it’s your software.

The last major adoption wave for financial management and accounting software dates back to the late 1980s, following the shift to Microsoft Windows. Every major financial software package today arose from this transition. QuickBooks, Microsoft Dynamics, Abila MIP, Oracle, and Blackbaud all pre-date the Internet.

The problem with these systems is that they were never designed for today’s always-on, always connected, always working world. Instead of being able to configure your system on the fly, you have to pay for costly, permanent customizations. As a result, you find yourself held back by vendor lock-in. This lack of flexibility also makes it difficult to get the reports you need, with the right information at the right time.

QuickBooks, Microsoft Dynamics, Abila MIP, Oracle, and Blackbaud all pre-date the Internet.

And that’s precisely why so many nonprofits are trapped in the past, struggling with old-fashioned, outdated financial management and accounting software packages. The fallout from using one of these older systems includes spiraling overhead costs, functional limitations, and unnecessary risks. What’s more, there’s a cost to not being able to gain real-time visibility into your organization’s financial and operational KPIs. It’s the cost of limiting your ability to make informed decisions about programs, fundraising, staffing, and more.

Your first decision

Choosing a software delivery model

If you are considering a new financial management system, there’s one decision you can, and should, make early on. Which delivery model will provide the highest ROI for your organization? Here’s a high-level overview to help you understand your three main options, followed by a chart with more details.

On-premises solutions. With this traditional model, you license software and run it on your own servers. When considering this model, be sure to account for the capital and operating expenses associated with deployment, operations, support, customization, integration, maintenance, and upgrades. While these costs can be too great for small and mid-sized organizations to sustain, on-premises solutions remain a viable option for some larger nonprofits. These organizations often have a built-out IT infrastructure, investment capital, and expertise to support and maintain major software applications.

Hosted solutions (single tenant). In a hosted environment, the software physically resides at a remote data center operated by an expert third-party hosting provider. Your team would usually use a product like Citrix to access the software over the Internet and see the screens being generated at the hosting provider. This model eliminates the responsibility of maintaining hardware infrastructure, and therefore can help you avoid large upfront capital expenditures. But it works by providing you with a unique “instance” of your financial system on a dedicated server. That means you would still face the same costs for customizations, upgrades, integration, support and service.

Cloud computing solutions (multi-tenant). Just like Google, Amazon, and online banking, cloud-based financial applications were built for the Internet age. Also known as “software as a service” (SaaS), these applications offer direct, always-on access to the solution, typically paid for on a per-user/ per-month subscription basis. They are multi-tenant, which means you can unlock only your own data, but you work from a shared system—a single set of resources, application infrastructure, and database. There are no upfront fees, capital investments, or long-term commitments because you do not buy, license, or manage the underlying hardware, software, or networking infrastructure. Upgrades are performed at no cost to you. Even if you make extensive changes to the system, your customizations “roll over” to work with the new upgrade.

Just like Google, Amazon, and online banking, cloud-based financial applications were built for the Internet age.

Software delivery models at a glance

| On-premises software | Hosted software | Cloud computing/SaaS | |

|---|---|---|---|

| Application development | Developed for the 1980s innovation of client/server, Windows-based computing. | Runs on-premises software in a third-party data center and adds a layer for online delivery (e.g., Citrix). | Developed from the ground up for online delivery. |

| Deployment | Installed on the customer’s own hardware. | Installed on a third-party vendor’s hardware – delivered via an internet connection. | A single vendor both develops and operates the applications – delivered via an internet connection. |

| Implementation | Usually 3-6 months. | Usually 3-6 months. | Usually 6-12 weeks. |

| Customization | Can be expensive and time consuming. Risk of “dead-end” customizations that break when new versions of software are released. | Same as on-premises. | Clickable configurations replace costly customization and do not break with application upgrades. |

| User interface | Designed for Windows machines in a client/server environment, and not always optimized for ease of use and learning. | Same as on-premises, with an extra layer for presentation (e.g., Citrix). | Designed from scratch for the Web environment, to match the paradigm users expect and are familiar with. Built from the ground up to be easy to use on multiple devices, with multiple operating systems. |

| Upgrades | 12+ months. | Same as on-premises. | Generally quarterly. |

| Integration | Difficult and expensive. | Same as on-premises. | Readily available via application programming interfaces (APIs). |

| IT Support | Generally provided by the customer. | Same as on-premises, but complicated by existence of third-party hosting vendor. | Generally included in the package from vendor. |

| Multi-tenancy | Not multi-tenant. Each instance of the application requires its own hardware/ software/networking environment. | Same as on-premises. | Applications are designed to be multi-tenant. |

| Hardware requirements | Requires a specific operating environment. | Same as on-premises. Users typically limited to Windows only. | Delivered via a Web browser so generally operating system and browser-agnostic. |

Considering cloud

Gut check: Is the cloud right for my nonprofit finance organization?

The cloud offers compelling and unmatched advantages for deploying business software, and particularly financial applications. Instead of continuing to invest in antiquated on-premises systems, leading nonprofits have turned their focus to SaaS and cloud-enabled software because they need flexible and agile financial applications that are relatively easy to implement, configure, and update. Demand for cloud-based financial applications continues to grow among nonprofits because of the ability to access and analyze massive amounts of data in real-time. With speed as a guiding factor to nonprofits globally, organizations want, and need, more from their finance systems than ever before, and that includes using the most up-to-date and advanced systems found in SaaS and cloud-enabled finance systems.1

While your next financial solution very well could be a cloud solution, it doesn’t have to be. And it certainly should not be a choice based on “what everyone else is doing.” Is the cloud right for your nonprofit finance organization? Conduct a quick gut check with these six questions.

1. Does my team need to work outside the office?

“Anytime, anywhere” accessibility is a key benefit of moving to the cloud. The whole finance team can work anywhere—in the office, at home, around the corner, or around the world—using only a standard and secure Web browser and an internet connection. You don’t need extra security hardware or software, or a VPN connection.

2. Does my nonprofit need to accelerate financial processes—without increasing headcount or IT budget?

High ROI and rapid payback are common with cloud applications. In a recent study by Nucleus Research, cloud-based financial management and accounting implementations were found to deliver 3.2x more ROI than on-premises software.2

Considerable financial advantages come from avoiding the capital investments and operating expenses associated with an on-premises system. But cloud systems also drive higher ROI through time savings and process efficiencies. Since cloud systems are inherently Web-based, live, and real-time, they greatly accelerate crucial financial processes like accounts payable, consolidations, grant management, and revenue recognition. Plus, modern cloud-based systems offer extensive automation and integration capabilities. You can go a long way toward eliminating productivity busters like manual data entry, paper-based processes, and spreadsheet maintenance.

3. Does my financial system need to integrate with Salesforce.com or other applications?

Easy integration comes with the territory in the cloud. APIs and Web services enable cloud systems to easily integrate with one another so your nonprofit can use the best applications for each functional area of the organization. This means you can leverage key data from donor management, payroll, budgeting, CRMs like Salesforce, and others to track metrics that are central to your organization’s operations and programs–without costly custom programming and maintenance from expensive IT resources.

4. Do my key stakeholders want or need self-service access to their relevant KPIs?

Real-time visibility is a hallmark of today’s cloud systems. You can provide access not only to traditional finance department users, but also to other stakeholders. For instance, many nonprofits that are adopting cloud financial applications provide real-time dashboards to their executive team, so they can monitor the key performance indicators of the organization. Others provide access to a broader range of employees so they can view dashboards, enter and approve expenses, view their budgets, and create purchase orders. Some also give auditors, CPAs, and board members real-time access to key information to build trusted relationships.

5. Does my nonprofit struggle with inefficient processes?

The cloud can help you gain organization-wide operational efficiencies. You can streamline classic finance processes—such as consolidations and closes. But you can also leverage the Internet to free-up resources for value-add activities by automating processes like procurement, allocations, grant management, and compliance reporting.

The cloud enables nonprofits to sidestep the pitfalls of “management by spreadsheet” and avoid the limitations of single-user systems like QuickBooks that trap information in desktop silos.

6. Do we need to scale for growth—on a smaller budget?

A cloud-based financial system lets you tap into a world-class infrastructure. Your vendor amortizes costs over thousands of customers, so they can maintain world-class infrastructure and provide you with 24×365 operations, continuous backups, disaster recovery, and superior security. This offers you a far higher level of performance, reliability, and security than you may be able to afford on your own. Plus, cloud applications can be provisioned immediately and are upwardly and downwardly scalable. So you can get started quickly and change on a dime.

Finance efficiency jumps 60% with move from on-premises accounting system to the cloud with Sage Intacct

Many nonprofits that are adopting cloud financials provide real-time dashboards to their executive team and board members, so everyone can monitor key performance indicators in real-time and make quick decisions that are crucial for mission success.

The Boys & Girls Clubs of Greater Tarrant County serves about 23,000 youth in the Fort Worth and Arlington areas of Texas with a range of programs geared to help young people mature into healthy, productive, caring, and responsible adults. The nonprofit provides after-school and summer programs, and initiatives focused on education, character and leadership, drug prevention, and gang intervention across 27 locations. With a $23 million annual budget, financial management is essential to the organization’s success.

Improving finance and accounting became a top priority when Robert Ehret, with a background in church and bank finance, joined the Boys & Girls Clubs of Greater Fort Worth as its CFO in 2014. (The club would merge with a sister club in Arlington to create the Tarrant County organization in 2018, with 290 full- and part-time employees). Ehret quickly found that the club’s previous on-premises accounting application, and heavy reliance on Excel, wasn’t well suited to the needs of a nonprofit organization.

“It was just so difficult to extract information,” Ehret said. “You couldn’t report across fiscal years, and the majority of our grants cross fiscal years. It was a very lengthy process just to produce board reports, and if you needed to make a change it was very painful to go through the whole process of making an adjusting entry and rerunning reports. There was no doubt we needed to make a change.”

Ehret set out to upgrade the organization’s capabilities. After a demo of Sage Intacct, he said, “If Sage Intacct does what I’m seeing in this demo, this is what I want. The dimension concept in Sage Intacct really captured my imagination, and it’s proven to be all I thought it would be.”

The move to cloud-based Sage Intacct has paid off with dramatically better efficiency and visibility for informed decision-making. Ehret says the four-person finance team is 50% to 60% more efficient with Sage Intacct, and productivity is up 30% to 40%. In one example, board reports that took an hour to complete with Microsoft Dynamics GP and Excel are now complete in minutes. “We’re not spending nearly as much time fighting to get basic information in or out of the system,” Ehret said. “That’s freed up more time for us to focus on better analysis and better reporting.”

The Boys & Girls Clubs of Greater Tarrant County increased efficiency by 60% and productivity by 40% by moving to the cloud with Sage Intacct. The move has paid off with dramatically better efficiency and visibility for informed decision-making.

Results

- Financial efficiency increased by 50 to 60%

- Board reporting cut from 1 hour to minutes

- $65,000 avoided in headcount

- Speed and simplicity in merging two sister clubs

1. Source: IDC MarketScape: Worldwide Cloud and SaaS ERP Accounts Receivables and Accounts Payables Applications 2018–2019 Vendor Assessment

2.Source: NucleusResearch.com

Evaluating solutions

Selecting a solution: It’s still about best practices

When it’s time to evaluate vendors for your financial system, it’s essential to remember that you are ultimately choosing a sophisticated software application. Even with cloud-computing implementations, the basic process of vetting vendors remains unchanged. Consult the basic evaluation checklist below—then be sure to continue to the next section for additional questions you should ask cloud vendors.

Gather requirements. Carefully define and document your needs. Get input and gain consensus from key users in finance and related departments across the organization. Do you need to integrate with CRM systems? Talk to development. Do you need to deploy new purchase requisition processes? Talk to accounts payable.

Identify top priorities and challenges. No system meets every need for every user. Determine which functionality and requirements are “musts” and rank them so that you can select the system that best fits your finance team’s unique needs.

Create an RFI/RFP. With requirements established, now’s the time to list your needs, expectations, and parameters on a Request for Proposal (RFP) form that you can send to a short list of vendors. Using the same form for all vendors will allow you to make an apples-to-apples comparison of solutions. Here is a helpful Nonprofit Accounting Software Buyer’s Checklist that can help you craft your RFP.

For real-world reviews by actual users, check out G2, Trust Radius, and the Salesforce.com AppExchange.

Research your options. Go online to develop a short list, sift through competing offerings, and comb through independent research and reviews. You can consult social networks like Linkedln and Twitter to connect with people that are already using the products you are evaluating. For real-world reviews by actual users, check out G2, TrustRadius, and the Salesforce.com AppExchange.

Demo or trial from short list. There’s no substitute for careful evaluation of the user experience. But also be sure to see how things work at the administrative level as well.

Focus on product fit. Don’t overlook the basic truth: Regardless of deployment model, there’s still no substitute for functional excellence. You need a financial system that offers the comprehensive, up-to-date features that modern nonprofits require. For instance, many organizations find that multiple entity consolidation and grant-based accounting are as essential as real-time reporting, process customization, automated approvals, and integration with other software products.

Regardless of deployment model, there’s still no substitute for functional excellence.

Check references, score, and select. Be sure you carefully screen vendor references. Make certain that vendors provide access to happy and successful customers, but don’t overlook online forums like G2, where you can access unscreened, unfiltered feedback about vendor performance.

Vetting cloud vendors

What to look for in a cloud software provider

When you move finance to the cloud, your vendor—not your IT department—will operate the financial system for you. This fundamental difference should have a major impact on your evaluation process. It’s not like the old days when you licensed software from the vendor, and then were on your own. In the cloud computing world, the vendor has to form a long-term partnership with you and continue to earn your business every month. So you need to ensure your vendor can do a better job at running your system than you can— and that it will keep up the good work, month after month.

Seven attributes to look for in a cloud vendor

1. Implementation success. The ideal cloud financial solution is designed from the ground up as a cloud application and is backed by a vendor and partners with extensive experience in the nonprofit industry. Make sure your vendor can point to a proven track record of successful implementations with nonprofit organizations.

2. Operational track record. Your chosen vendor isn’t merely developing and licensing software. They’re managing the financial systems that run your nonprofit’s finances— which makes the partnership strategic for you. Find out how your vendor conducts business. What’s the cultural fit with your organization? What standards do they pursue? Where are the applications physically being run? What kind of care and support can you expect?

3. Data ownership. Ensure that it is unambiguous that you own your own data and can obtain a copy of your data (for an appropriate fee) if your relationship ends. You’ll also want an agreement for appropriate assistance in migrating away from the vendor should you ever decide to leave.

4. Infrastructure and security. Most cloud-computing vendors partner with elite data center providers that provide the backbone to their offerings. Find out who those partners are. Where are the data centers located? What are the business-continuity contingencies?

Ensure your vendor can do a better job at running your system than you can—and that it will keep up the good work, month after month.

What security standards have they adopted? Can they deliver guaranteed and appropriate levels of uptime? How do they prevent, detect, and remediate physical and network security breaches? Thoroughly evaluate each vendor’s network operations center and technology infrastructure.

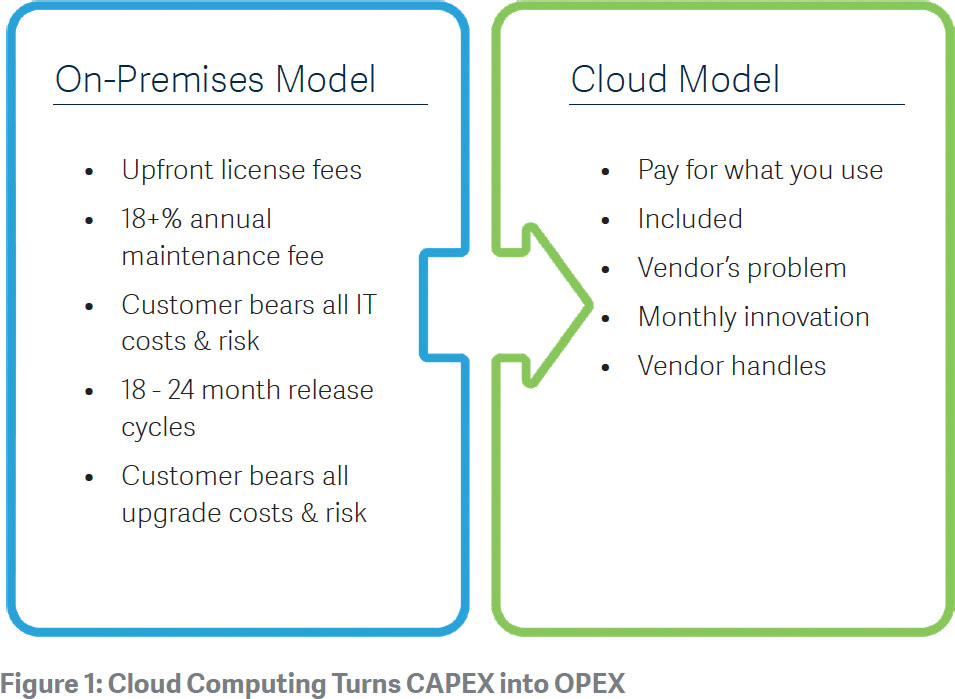

5. ROI/TCO. Although the financial models can vary significantly, the total cost of ownership is typically far lower for cloud computing systems than it is for on-premises and hosted systems. Take the time to carefully structure proper ROI scenarios and timelines to determine the investments and payback periods. The only ongoing costs should be monthly fees for the software subscription, training, and configuration. If you are comparing cloud to on-premises, remember that software licensing for an on-premises solution actually makes up a very small percentage of its total cost. Additional ongoing costs may include customization, hardware, IT personnel, maintenance, training, tuning, network maintenance, and much more. And that translates into a far more difficult investment hurdle. What’s more, cloud computing costs are taken entirely from OPEX, whereas on-premises deployments typically include even larger OPEX plus significant CAPEX investments. (See Figure 1.)

Cloud Computing Turns CAPEX into OPEX

6. Support agreement. A good support agreement will specify what level of support is free with subscription and will offer several levels of additional support. If it is important to you to have access to U.S. based experts, find out where your vendor’s support team is located. It’s also a good idea to inquire about the people on your support team. Will there be accounting experts and seasoned representatives available to you, if needed? Beyond technical support, how else will your vendor support you? (e.g., will you have a dedicated customer account manager?)

7. Service level agreements. Given the stakes, a world-class service level agreement (SLA) is a non-negotiable requirement when dealing with a cloud-computing vendor. With cloud computing, you rely more heavily on your vendor for support. You can’t simply walk down the hall to ask your IT department for assistance if you encounter a system problem. Make sure your vendor has the appropriate infrastructure to offer the best expertise and responsiveness, and be sure to get an ironclad, comprehensive SLA. As the basis of your relationship, this document can be enforced for many years and is essential to setting expectations and insulating your organization from risks. Look for SLA transparency from vendors who are unafraid to publish 12-month histories and current system status on their public websites. lf a vendor does not have a public system-status website, it should be a major red flag that they may not have a complete handle on their operations.

Seven SLA must-haves

Your vendor’s Service Level Agreement should specify incentives and penalties for these performance metrics—and more. Make sure you’ve got the following areas covered, in writing:

1. System availability. Look for a vendor that can commit to 99% availability or higher.

2. Disaster recovery. If there’s a data center disaster, make sure that you’ll be back up in 24 hours, and that you’ll lose no more than 2 hours of data.

3. Data integrity and ownership. If you decide to leave your cloud vendor in the future, you should be able to get your data out of the vendor’s system—period.

4. Support response. As a general rule, your vendor should be transparent about what constitutes a high priority, medium priority, and lower priority issue—and should be able to respond to high priority requests within one to two hours.

5. Escalation procedures. If you have a support case that you feel needs to be escalated, be provided with a clear escalation path and the contact information of at least three people to contact.

6. Maintenance communication. Your vendor should let you know when regular recurring maintenance activities take place, and should post a special notification if any maintenance activity is expected to take longer than normal.

7. Product communication. Your vendor should commit to providing regular updates on new product features and product release notes.

Buyer beware

How to be an informed buyer

As the buyer of a cloud solution, you’re in control. Again, cloud vendors must earn your business every month. They are motivated to look past the initial sales transaction and focus on a long-term relationship that keeps you happy. After you’ve done the hard work of assessing your requirements, drawing up your short list, and selecting a vendor to do business with, make sure that you understand what you are going to be paying for and when.

Two bits of guidance:

1. Be wary of steep upfront discounts. Protect yourself by ensuring your agreement includes caps on price increases over time, or you can find yourself with a nasty surprise at the end of your first year of service. If a vendor offers steep discounts or “free” product, be skeptical. Ask questions to understand what you are actually getting. Be mindful of your future needs–many users of these products experience a huge increase in price when they grow.

2. Factor in all the variables to avoid surprises. Pricing models for cloud applications vary widely. Some vendors charge an all-in-one fee. Others might break out various components like maintenance, support, or training and then add overage charges based on the number of users or number of transactions.

Conclusion

You are in the power seat

With so many alternatives for financial applications, nonprofit finance leaders must ensure they understand the implications of all options: on-premises, hosted, and cloud computing. Ultimately, cloud computing is about capitalizing on a new software delivery model that accelerates payback of a larger ROI and better aligns the financial organization with the new dynamics of growing nonprofits.

In this guide, you’ve discovered why legacy systems make it difficult to get good financial information, what to expect from a modern cloud-based solution, and how to make sure you choose the right solution for your organization. In today’s market for accounting applications, the buyer has the power. No matter what solution you choose, you should expect faster financial closes, easier regulatory compliance, less manual work, real-time visibility and reporting, and an outstanding service level agreement.

Good luck with your buying journey!

About Sage Intacct

Sage Intacct is the AICPA’s preferred provider of cloud financial applications. Specializing in helping nonprofits of all types—including faith-based organizations, charities, trade and membership associations, and cultural institutions—Sage Intacct streamlines grant, fund, project, and donor accounting, while delivering real-time visibility into the metrics that matter.

Our modern, true cloud solution, with open APIs, gives nonprofits the connectivity, visibility and efficiency they need to do more with less. At Sage Intacct, we help nonprofits strengthen stewardship, build influence, grow funding, and achieve mission success.