The number of ERP solutions suitable for nonprofit accounting is growing, and making a decision on which one to go with can be tough. The following is a hard-nosed look at two platforms that have been around for decades, but have managed to keep up with market demand in an increasingly competitive landscape.

Before we compare Blackbaud Financial Edge and Community Brands MIP Fund Accounting, let’s talk about the software they offer and who it serves. The easiest way to classify these customers is by using the same terms the IRS uses – 501(c) registered organizations.

So, what is so special about the way nonprofit organizations manage their business and maintain their financial records that a specialized solution is required?

I could simply refer back to the IRS again and then drop my mic, but I think you are expecting more than that. I suppose I should start by defining “fund” accounting, the key term associated with nonprofits. The Governmental Accounting Standards Board defines fund as “a fiscal and accounting entity with a self-balancing set of accounts recording cash and other financial resources, together with all related liabilities and residual equities or balances, and changes therein, which are segregated for the purpose of carrying on specific activities or attaining certain objectives in accordance with special regulations, restrictions or limitations.” This is different from Commercial accounting, which only serves one purpose; create a single ledger where turning a profit is the number one goal.

Let’s take a comparative approach with two leaders in the fund accounting space: Blackbaud’s Financial Edge & Community Brands’ MIP Fund Accounting. We’re pitting the two products against each other because they are both leaders in this space. And let’s face it – it’s not easy finding the right solution.

On paper, the two solutions are fairly evenly matched: Blackbaud has designed a modular system that appeals to nonprofits and most agencies. Community Brands also has a modular system that works for any 501(c) registered organization, including government entities. Also, referring back to the definition of fund accounting I gave you earlier, both solutions have the ability to maintain separate, balanced books for each fund and track the nature of restrictions on fund balances (i.e., net assets).

So, where do the two solutions differ?

Data Visualization

They differ in how they approach data visualization (i.e. dashboards), but do well when it comes to reporting individual funds and providing a consolidated view. Financial Edge & MIP seem to have collaborated together when they architected their respective dashboards. Both break information into categories (AP, AR, Cash Flow, etc.) and provide snapshots of what is most important in each category. Both vendors allow you to drill down into transactional detail.

Financial Edge allows for a bit more collaboration; you can share your dashboard or a piece of it. MIP allows users to customize the viewing panels based on your role in the organization. The key difference is that Financial Edge provides a dashboard to all users, whereas MIP only provides one to those who are hosted in their cloud.

Payroll

When it comes to Payroll, the vendors are on opposite sides of the spectrum. Financial Edge’s payroll module can be tricky to use and labor distributions can be a bit wonky. Customer feedback has been neutral on the Payroll solution in Financial Edge. Yet, the common theme from users is that it is very difficult to set up, there isn’t enough support, and there are too many product enhancement requests for customers to consider this a mature product. On the other hand, MIP has mastered this area, even going two steps further and offering an HR tool and Electronic Timesheet/Benefit Enrollment module.

Partners

Community Brands recently acquired Abila as the owner of MIP Fund Accounting, and they’ve done a great job of preserving past relationships that the prior owners built. They have poured resources into Research & Development and we’re excited to see the next few phases of their plan. On the other hand, Blackbaud decided to temporarily abandon their old ways of working with channel partners, which had a negative impact on their business. This happened a few years ago, and thanks to nervous investors, Blackbaud’s Leadership Team reversed course and returned to working with channel partners.

Implementation

Another glaring difference between the two companies is their approach towards implementation. Most Financial Edge customers will be working directly with Blackbaud staff for training and implementation. During the sales process, expect to be presented with information (think “upsell”) on the other solutions under the Blackbaud umbrella. I’m not against you putting all your eggs in one basket, but you should realize that there is no such thing as a one-size-vendor-fits-all (Google it. Bet you can’t find one).

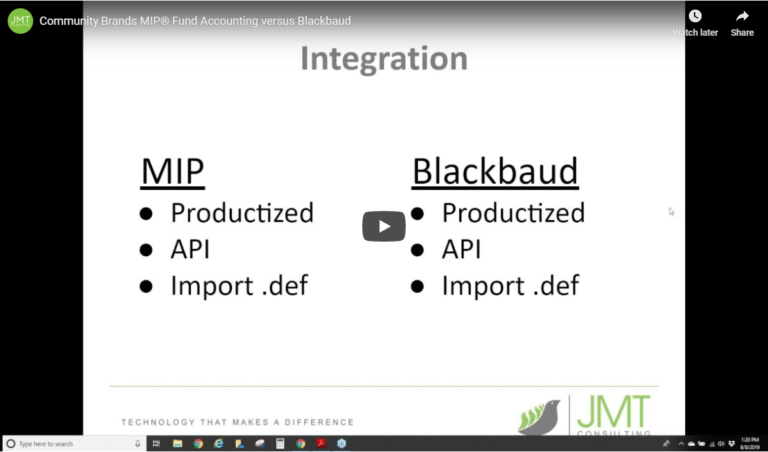

With MIP, you could work directly with them, but it’s much more likely you will be working with a (certified) Implementation Partner. The good ones will identify all your needs during the discovery phase of the sales process and will prescribe solutions based on need, not availability. At some point in time you will be introduced to the Community Brands Partner Ecosystem. This is an online resource for customers to identify other Developers & Integrators who can help them at any stage. A good example is when a customer already has a Fundraising CRM or Grant Management platform and they want to build an integration with MIP. The Partner Ecosystem from Community Brands makes it easy to identify all available resources and request more information.

For a full comparison of these products, listen as Dan Wharton and Brendan Sohan of JMT Consulting walk through the pros, cons, differences, and what to watch out for between Blackbaud and MIP Fund Accounting.

Identifying the right partner to help you through the selection process, implementation, and towards long-term sustainability is just as important as choosing the right software. Learn more about our software partners and how we help our clients find custom-fit solutions for their needs.