For the first time in over 20 years, there will be considerable changes in the way nonprofit organizations are required to prepare and present financial statements. On August 18th, 2016, The Financial Accounting Standards Board (FASB) issued Accounting standards Update (ASU) 2016-14, Not-for-Profit Entities (Topic 958), Presentation of Financial Statements of Not-for-Profit Entities.

The goal behind the update is to help nonprofits tell their financial story more effectively, make financial statements more useful to readers and provide more consistency between reporting organizations. John Alfonso gave a detailed presentation of the ASU at INNOVATE this year. You can read an overview of his presentation here and download his presentation slides here.

In this post, I’ll share with you a few slides from my upcoming presentation at this year’s Intacct Advantage conference. My goal is to condense the key facets of this important update to help you make sure your nonprofit is prepared for the coming changes.

When will the changes become effective?

The ASU is effective for fiscal years beginning after December 15, 2017, and for interim periods within fiscal years beginning after December 15, 2018. These amendments should also be applied retrospectively to all periods presented. Your nonprofit can elect to adopt these changes earlier if you wish.

If your nonprofit presents comparative financial statements, you are allowed to leave out the following information for any periods presented before the year you adopt the ASU.

- Analysis of expenses by both functional and natural classifications

- Disclosures about liquidity and availability of resources

What Are the ASU’s Primary Changes?

There are five primary areas of change that nonprofits should prepare for:

- Net Asset Classification

- Expense Classification

- Investments

- Liquidity Information

- Cash Flow Statements

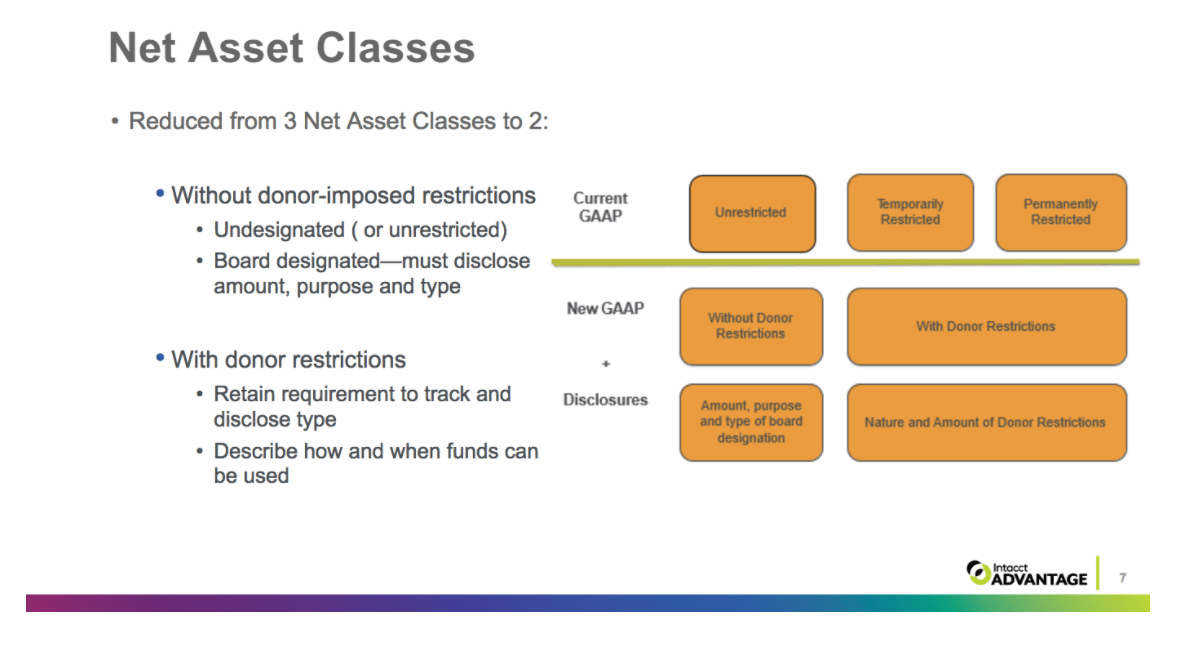

Net asset classification

Net asset classes have been reduced from 3 to 2: There is now only “with donor restrictions” and “without donor restrictions”

You can present the net assets with donor restrictions as separate lines right on the statement of financial position or in the notes to the financial statements.

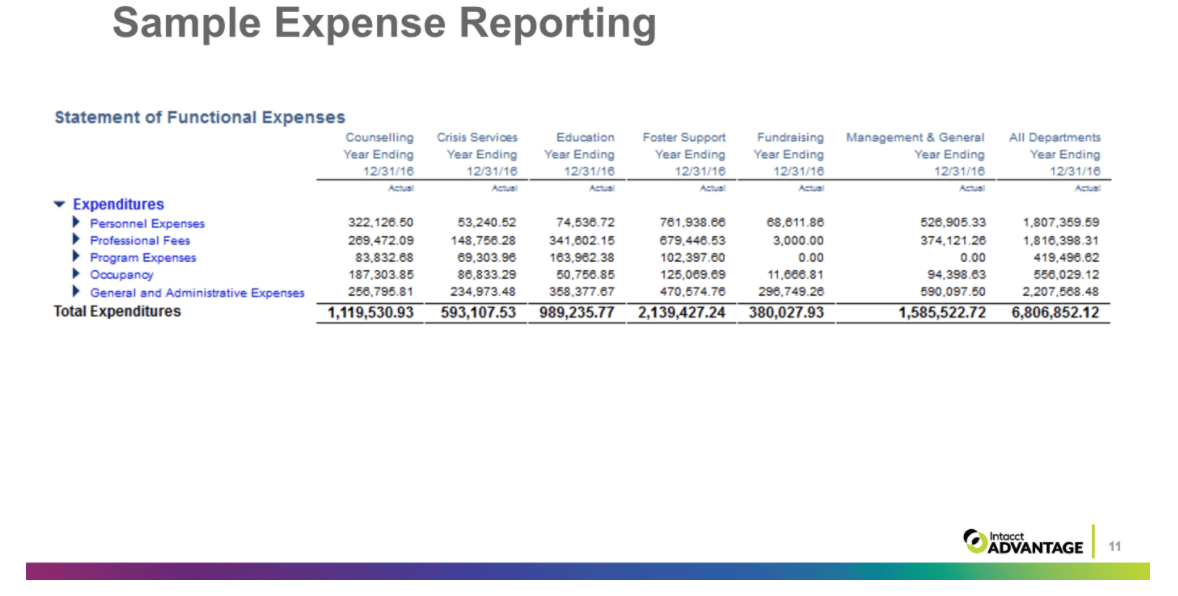

Expense Classification

Your Nonprofit must now report expenses by both nature and function. This report can be included as part of the Statement of Activities, as a separate statement, or in the note disclosures. Disclosures should include methods used to allocate costs between programs and supporting activities. You should provide disclosures about methods used to allocate costs among program and support functions.

Here’s an example of what your expense reporting might look like:

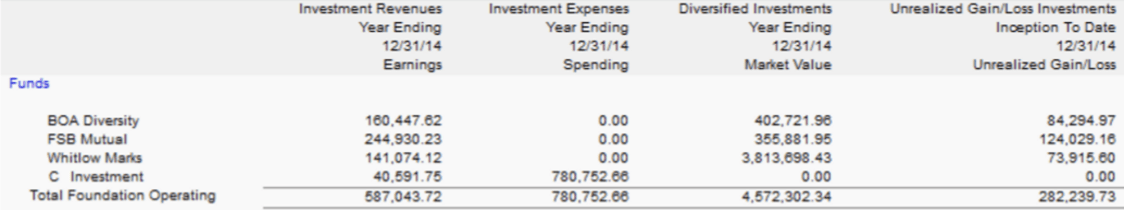

Investments

When reporting investments, your nonprofit should present the NET of all investment-related expenses both internal and external. This should be presented on the face of the statement of activities. You no longer have to disclose netted amounts (except for the disclosure of the amount of internal salaries and benefits that have been presented net against investment return).

Liquidity information

Availability of a nonprofit’s liquid assets and its management of those assets is of key importance to donors, creditors and other entities in order to understand financial standing. This reporting can be separated into two categories:

Qualitative

Nonprofits must communicate the status of liquidity and the availability of funds within one year of your Statement of Financial Position’s date.

Quantitative

Nonprofits must also express the availability of unrestricted liquid assets as of the date of the statement of Financial Position to meet operating cash needs within one year of the statement date.

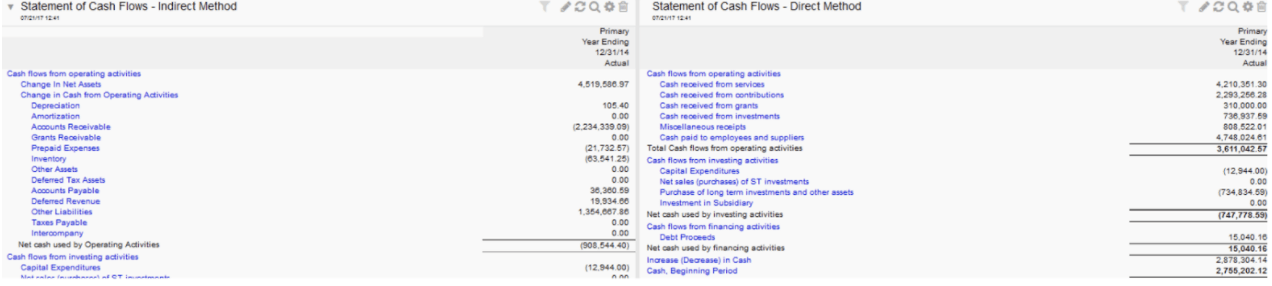

Cash flow statements

For your nonprofit’s cash flow statement, select whether you’d like to use the Direct or Indirect method. If you select the Direct Method, the indirect reconciliation is no longer required. Here are what the two methods would look like side-by-side.

Next Steps

If you would like a thorough overview of the new ASU, make sure you check out John Alfonso’s recent post. You can also visit FASB.org for sample statements and disclosures in the ASU, along with implementation guidance and illustrations. Another great way to gain an understanding of the changes is to access the official ASU and read the “Summary” and “Basis for Conclusions” sections at the beginning and end of the document.

In order to stay up-to-date, we recommend signing up for electronic alerts from the FASB, listening FASB webcasts and reviewing financial statements of other large nonprofits who adopt the changes early. We wish you the best of luck in your adoption of ASU 2016-14. Don’t hesitate to reach out with any questions. JMT is here to help!