Philosophers would contend that Sisyphus had it rough, rolling his rock up a hill only to see it roll back before he reached the top – then doing it all again, over and over, in perpetuity. As agonizing as Sisyphus’ plight may have been, it’s nothing compared to the existential financial and mission challenges nonprofit leaders face today. Sisyphus had only one rock to roll up one mountain, while dedicated leaders in the nonprofit sector find themselves rolling multiple rocks of various sizes up multiple mountains.

During this unprecedented time, many nonprofits have felt pressured to prioritize the short-term financial question of liquidity—i.e. scraping together enough cash to meet payroll and pay rent. But the focus on short-term questions and challenges, though understandable, might ultimately be short-sighted, causing organizations to overlook some of the most important longer-term existential questions and challenges that have the potential to define a nonprofit’s financial viability, mission relevance, and impact over time. In other words, the existential survival question of “Are we here?” might be superseded by another, more fundamental existential question: “Why are we here? What is our raison d’être, our ‘reason to be’ as an organization?”

That is not to diminish the very real and unenviable plight of the overburdened nonprofit financial and mission management team just trying to stay afloat in the short term. Nonetheless, nonprofits during this time are called to meet the ultimate existential challenge of making mission and financial decisions for the long-term concurrently with the short-term questions, not putting them on hold for a later date. Because ultimately, a nonprofit’s ability to answer long-term financial and mission-defining questions concurrently with the short-term ones will position them to be relevant and make an impact in a realigned and ever-changing world of need.

To deal with multiple existential challenges, start by taking a step back and taking stock of your options

All nonprofits must take a reflective step back to understand their financial and program position before, during, and after the COVID-19 tsunami of change. Reality dictates a better set of short- and long-term financial and mission options for a self-aware organization with a balance sheet that can highlight even a modest reserve of unrestricted liquid net assets. Likewise, your business and mission options are enhanced if you have built a sustainable business model that supports a basket of effective programs, raises money from a diverse array of long-term funding streams, and all the while keeps expenses under control. Understanding the strengths and weaknesses of your business model enables you to focus on programmatic imperatives during a time of need. One nonprofit, with some unrestricted reserves, actually gave their staff raises at the outset of the coronavirus pandemic, which they felt were not only overdue but also necessary to position themselves for the longer term.

One could argue that during a time of existential flux, it is the fiduciary responsibility of nonprofit finance committees, boards, and CEOs—especially those with sizable unrestricted reserves—to structure a planning process to invest in a pipeline of new programs, innovations, financial function capacity, and perhaps even new program leadership. They should rethink their development capacity and strategy to make a compelling systemic case for the organization to not only survive the current conditions, but to continue to grow their measurable mission impacts through this uncertain period. Management can exude confidence in their mission expertise and ability to deliver on financial and mission goals by prioritizing unrestricted contributions, rather than becoming mired in ongoing liquidity concerns. An organization who wants some control over its mission destiny during both hard times and better times needs to think ahead about building the capacity to plan and launch new programs to meet new societal needs, and align that program planning with a research & evaluation capacity to determine long term program impact. Organizations that are able to put the organizational short-term liquidity crisis in perspective will emerge with an existential mission and financial ‘reason to be’.

Mapping the continuum of nonprofit financial health and mission independence

With different organizations facing an array of various existential challenges, it is probably safe to assume most organizations fall along a continuum of financial solvency and mission independence. Let’s posit mission and financial independence as the optimal endpoint of that continuum. Meanwhile, at the beginning of the continuum, let’s refer to the least optimal position as a complete dependence on moneyed outsiders who attempt to bend the direction of the organization’s mission away from management’s expertise and evidence-based programs. We draw these two positions as the endpoints because ultimately, financial independence depends on mission independence, just as mission independence depends on financial dependence; they form a positive feedback loop of mission and organizational nirvana.

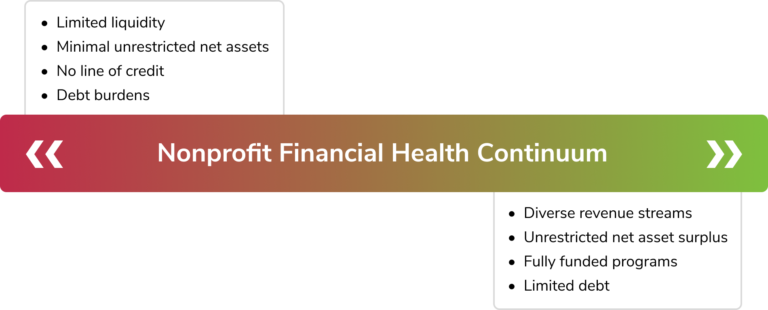

The Financial Continuum: Reading the Statement of Financial Position

The metrics for determining what it means to be in the least advantageous financial position on this continuum can be found in the Statement of Financial Position, where you’ll see evidence of limited liquidity, minimal unrestricted net assets, net of fixed assets (especially space), no line of credit, debt burdens, and an inability to bill and collect receivables. Moving towards the positive end of the continuum, you’ll find an organization with unrestricted surplus, unrestricted deficit with a strategic investment story, fully funded program needs (including indirect costs), unfunded program needs being met, the building and maintaining of diverse revenue streams, and an indirect cost rate being collected that actually covers indirect costs. At the very end of the optimal side of the continuum, you’ll find organizations that have built up a significant surplus of unrestricted net assets, including some management control over unrestricted board-designated net assets, set a flexible spending rate to meet immediate and future needs, limited their debt, and developed a capacity to invest in long-term revenue streams.

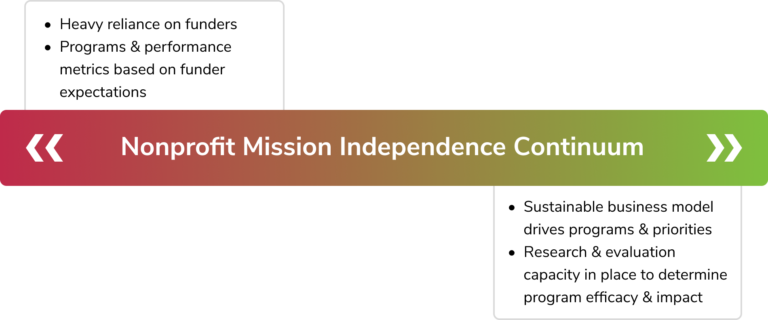

The Mission Continuum: Mission Independence or Heavy Reliance on Funders?

The continuum model assumes that mission independence is critical for long-term mission success. The least advantageous position is short-term programmatic structure that is driven, at least in part, by management’s reliance on funders—whether government, foundations, wealthy donors, boards, or other outside influences—whose expectations and performance metrics are often based on a limited or alternative understanding of what works and what doesn’t. As we’ve seen in the COVID-19 response debate, reliance on the mission experts is critical. To make progress toward the positive end of the continuum requires running sustainable programs that align with the business model, and investing in research and evaluation to determine the programs’ efficacy and impact over the long term. In organizations closest to the optimal point on the continuum, you’ll find mission effectiveness attracting diverse revenue streams, innovation being rewarded, a fully funded amalgamation of core mission programs, and a keen awareness of the structure of grants and contracts that offer some flexibility to make necessary modifications over time.

The perks of concurrent rather than consecutive long-term decision-making

Unfortunately, even before the COVID-19 crisis, the reality for many organizations was that they were stuck on a mission and financial treadmill, unable to plan and strategize for programs and possibilities that were even remotely longer-term. The intensity of the current crisis stokes the fear that organizations that were on the precipice of jumping off that treadmill and moving toward mission independence will now fall back into a mode of being concerned primarily with short-term liquidity. If and when the liquidity issues are managed, those nonprofit leaders are often too tired, afraid, nervous, risk-averse, or prematurely satisfied by the latest avoidance of insolvency to energetically prioritize questions of long-term financial investment in the mission.

As a result, the longer-term financial drive and proactive decision-making necessary to achieve financial and mission independence becomes an unmanageable or ignored organizational goal. The ultimate existential nightmare for such organizations who continue to “walk the treadmill” is that other driven, resourced organizations with an evidence-based approach to risk and reward are able to make long-term strategic decisions even while they address short-term imperatives. Those organizations making decisions consecutively—moving through consecutive phases of short-term, then long-term, then short-term decision-making—will remain stuck on a financial and mission treadmill with no path forward. Like Sisyphus, their rocks are already rolling back down the hill, and the chance to take a breather and look around the rock at what’s on the other side of their mission and financial climb, is quickly passing them by.

This article was written as the first installment in a guest blog series by Russell C. Pomeranz, President and CEO of Claverack Advisory Group.