Equipping Your Nonprofit With Exceptional Accounting Software

What turns a nonprofit into a successful, sustainable, scalable organization? A focused mission helps; an impassioned staff certainly plays a role, and an engaged donor base goes a long way. Important as these may be, however, the answer is more mundane: accounting.

Just like other organizations, nonprofits depend on funding to facilitate all of their activities. How well they move that funding through their organization says everything about the performance and outcomes they achieve. Lots of input goes into the good work that nonprofits do – but accounting is what ultimately makes that work possible over and over again.

Unfortunately, it can also do the opposite. Nothing compromises a nonprofit more quickly, completely, or permanently than accounting issues. They can cause financial turbulence over the short-term and undermine donor confidence over the long term. And even when accounting isn’t making outright mistakes, inefficient processes can waste time and distract staff away from other things.

Whether accounting has positive or negative consequences for a nonprofit depends, in large part, on the software at the center of it. The quality of accounting and the quality of the accounting software are inextricably linked.

In that context, nonprofits with Quickbooks or Fund EZ must think seriously about whether those basic tools can meet their accounting needs, now and later. They also need to think about what the right replacement looks like, one that aligns their needs, wants, budget, and timeline.

The nonprofit accounting experts at JMT Consulting are here to walk you through the decision-making process. Explore whether an upgrade to accounting is due, overdue, or drastic. Then explore two leading options, one of which will suit the needs of every nonprofit.

Signs of Insufficient Accounting Software

More than just an annoyance, the wrong accounting software puts a nonprofit at significant risks and constrains its growth in serious ways. Accounting woes can alienate faithful funders, attract the ire of regulators, trigger costly legal challenges, and damage an otherwise respected public image. And even when the software isn’t causing expensive mistakes, it may be the source of unacceptable inefficiencies that drain resources from nonprofits with few to spare. The lesson – one we’ve learned from working with thousands of nonprofits to improve their accounting – is that the wrong software isn’t an inadequate tool; it’s an active liability that nonprofits need to address before it spells disaster for accounting. These signs suggest it’s time for an upgrade:

- There’s a Workaround for Everything

With software that’s not built specifically for nonprofit accounting, it takes workarounds and supplemental spreadsheets to accomplish even the basics. These are temporary fixes at best. And while they may work, Jerry-rigged processes rarely work well. If the accounting software can’t handle all things accounting, it’s inadequate by definition.

- Accounting Lacks Transparency & Oversight

With rising expectations to prove they’re using funds responsibly, compliantly, and effectively, nonprofits need software that provides perfect visibility into the chart of accounts. Basic accounting software struggles in that regard. Accountants spend more time searching for the metrics and data they need only to come up incomplete with frustrating frequency. Accounting software shouldn’t obscure information – it should do the opposite.

- The Audit Trail Leads Nowhere

Basic accounting software comes with basic financial controls. With Quickbooks, for example, some editions allow users to alter financials after the fact without recording the change, which would cause an audit trail to go cold. This is a clear example of what the wrong accounting software does: make key accounting requirements harder to complete and less certain of doing right.

- Manual Tasks Overwhelm Accounting

One common characteristic of underwhelming software is a reliance on users to manage data. Instead of utilizing automation to collect, integrate, organize, and process data, this software makes accountants perform some or all of this work. Manual entries can be a massive waste of time, not to mention a notorious source of human errors and preventable accounting mistakes. The more input the accounting software requires, the more it merits replacement.

Introducing Sage Intacct and MIP Fund Accounting

Out of a crowded market for accounting solutions, nonprofits consistently choose Sage Intacct or MIP Fund Accounting. These two solutions power a large percentage of all the finance departments in the nonprofit sector. Ignoring other options to focus on Sage Intacct and MIP Fund Accounting is already a savvy decision because neither option disappoints when a nonprofit needs an immediate and extensive lift to their accounting function. Here’s a snapshot of both solutions:

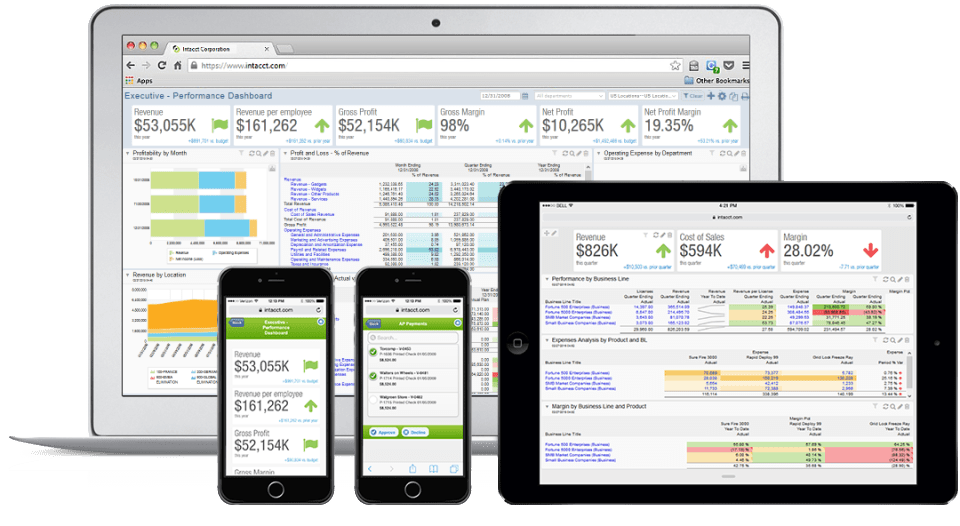

Some of the largest nonprofits in the country rely on Sage Intacct to serve as the centerpiece of their accounting and finance requirements. It combines a vast and powerful feature set with the ability to seamlessly integrate with other leading business solutions like ADP, Salesforce, and MANY more. Sage Intacct was also built specifically for the cloud so that users can access the entirety of accounting – all data and features – from anywhere. As a complete solution for nonprofit accounting, Sage Intacct does not disappoint.

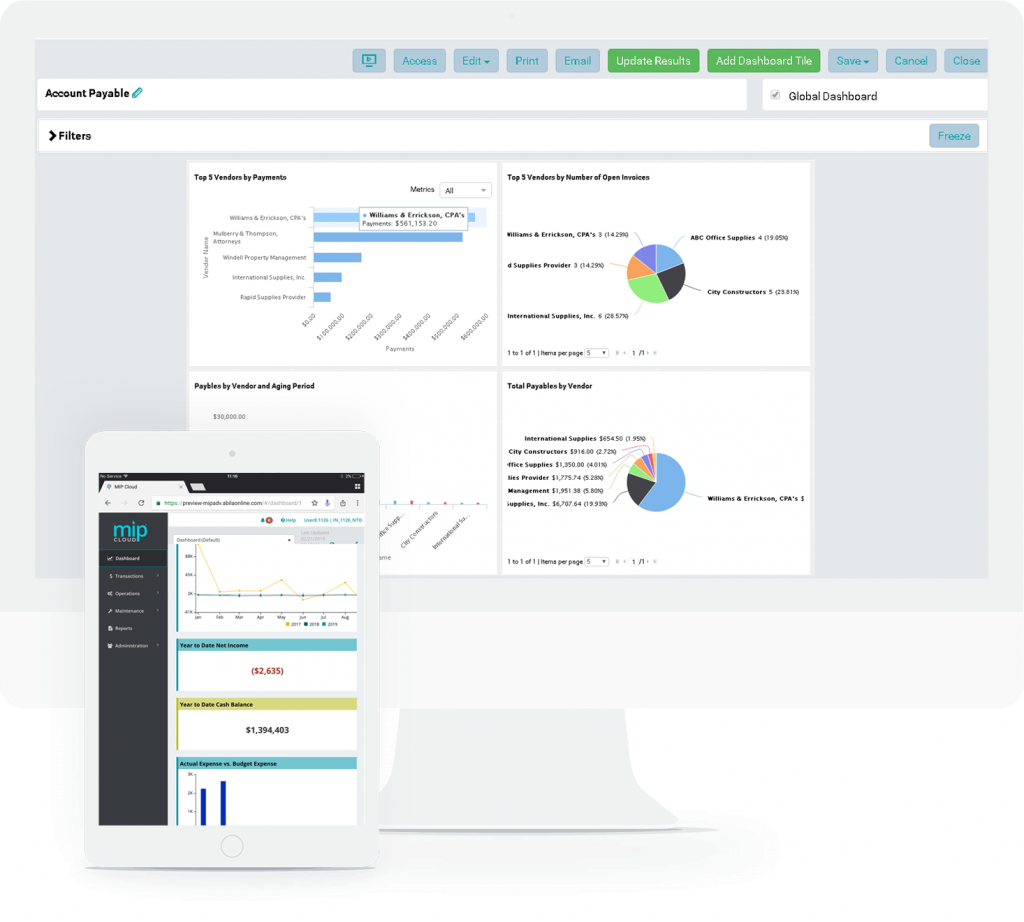

Leading the category of affordable accounting software for nonprofits, MIP Fund Accounting offers a financial toolkit that’s a lot larger than its price. The software was built specifically for nonprofits, not for general accounting purposes, which makes the features highly relevant and instantly intuitive. Users discover they can accomplish a higher caliber and volume of work despite spending less time on accounting and feeling less anxious about the integrity of the numbers. Compared to the average accounting solution, MIP Fund Accounting provides a complete and total upgrade for nonprofits specifically.

Either of these solutions can handle the fundamentals of accounting within the unique context of mission-based organizations funded by grants, awards, or donations. Fund accounting is one area where general or introductory accounting software really suffers. It lacks features for tracking funds from multiple different sources as they travel through an organization, which makes it harder to preserve compliance, transparency, efficiency, and accountability. Not with Sage Intacct and MIP Fund Accounting: Both solutions make fund accounting a priority using a multi-dimensional chart of accounts, user-friendly automation, and streamlined reporting capabilities.

Beyond fund accounting, each solution gives a nonprofit the robust, scalable accounting tools it needs to wisely manage money in whatever ways it intersects with the organization. In software selection, two questions matter most: Can this option do everything I need, and does this option improve on what I already have? With either Sage Intacct or MIP Fund Accounting, the answer is yes for any nonprofit.

Breakdown of Features

Multi-Dimensional Chart of Accounts

Unlimited Segments

Manage Grant Funds

Limited

For Governments

Integrated Payroll and Human Resource Management

With Add-on Module Purchase

With Add-on Module Purchase (Plus Integration with Other Industry-Leading Providers)

Cloud-Based Interface

With Some Module Exceptions

G2 User Review Rating

Limited

Workflow Automation

Selecting Between Two Strong Options

Sage Intacct and MIP may share similar core functionality, but they’re not identical products or appropriate for the same nonprofits.

Sage Intacct offers a more extensive, intuitive, and intelligent selection of features, all within a platform considered one the most powerful among all the options for accounting software on the market. Users can also take advantage of a rich, cloud-native experience that ensures financial data moves seamlessly (yet securely) through the nonprofit and to all parties that need it. Sage Intacct appeals to organizations that need cloud accounting software for nonprofits that can handle sophisticated accounting requirements at scale. In exchange for exceptional capabilities, however, users pay a premium. All of them consider it worthwhile, but the cost of Sage Intacct might put it out of reach for some nonprofits.

MIP Fund Accounting looks like an ideal option for nonprofits that want something similar to Sage Intacct at a fraction of the price. The feature list may not be identical in depth or breadth. There are some things Sage Intacct does better. But many nonprofits don’t need an industry-leading accounting software – they need an all-in-one solution that’s purpose-built for nonprofits and capable across the board. MIP Fund Accounting perfectly fits that description. It appeals to organizations that want to upgrade everything about their accounting software without similarly inflating their budget. Compared to other options deemed “affordable accounting software for nonprofits,” none offers so much for so little.

Final Choice: MIP Fund Accounting vs. Sage Intacct

At JMT Consulting, we are big believers in both these solutions. We recommend one or the other to most of the clients that contact us for help selecting their next nonprofit accounting software. How do we decide which one is right? It’s complicated, of course. Organization size, annual revenue, growth plans, process complexity, and overall philosophy on technology are all factors that we explore closely when debating Sage Intacct vs. MIP, and the reason we work closely with each of our clients to thoroughly understand both their short-term and long-term requirements before making a recommendation.

If you’re ready to explore which is the right fit for your organization, book a free consultation with our nonprofit experts today!