This post was published as part of our guest blog series by our software partner, AvidXchange, the industry leader in automating invoice and payment processes.

With today’s reality forcing businesses to quickly implement and put their continuity plans to the test, it’s becoming clear which core processes are critical to maintaining operations.

Accounts payable (AP) ranks near the top of that list, as businesses literally can’t function without processing payments.

But many companies still rely on manual, paper-based AP processes, which is making it difficult to ensure they run smoothly during this unpredictable time of duress.

New AvidXchange Research Reveals Gaps in Business Continuity Plans

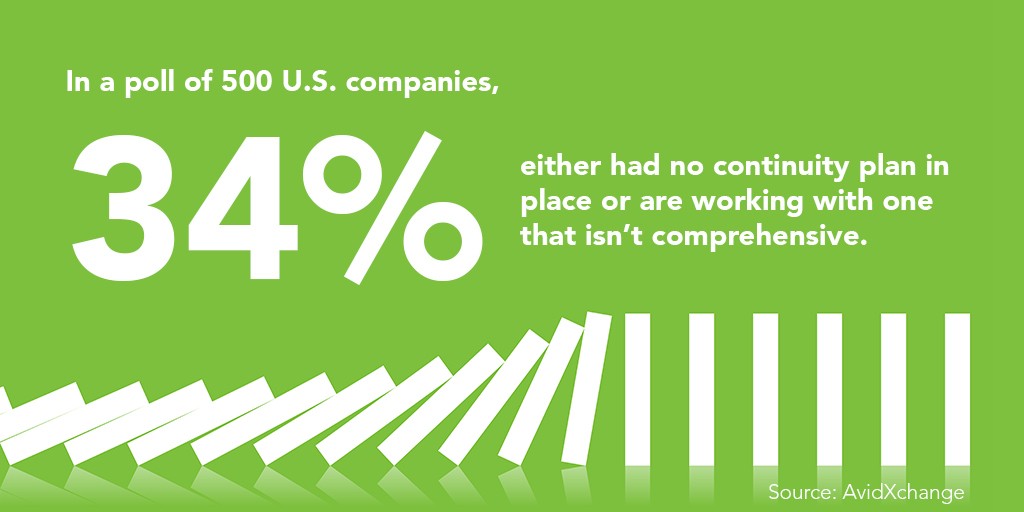

A few weeks ago, AvidXchange polled senior management from 500 U.S. companies to see how many had business continuity plans they felt confident in, whether or not they felt technologically equipped to act on those plans, and how that combination could impact their business’s ability to pay their bills.

Only 37 percent actually had the necessary technology to enable employees to work from home, and only 54 percent felt equipped to continue paying their bills while working remotely.

Almost 20 percent stated their business could only continue normal operations for 2-3 weeks if cash flow was interrupted due to late payments.

Fortunately, AP automation can help keep business moving by ensuring your AP department can continue to approve invoices and make payments securely and efficiently at any time, from any location.

Here Are Six Specific Ways AP Automation Can Bolster Your Business Continuity Plans

1. AP Automation Provides A Central Hub for All Your Payment-Related Files

Activating your business continuity plan likely means that you can’t be in the office, sifting through file cabinets. You’ll want to be able to quickly access any payment-related file with the click of a button.

AP automation provides a cloud-based, central repository, so you don’t have to rely on those file cabinets. And because it’s in the cloud, anyone can access it from anywhere.

2. Anytime, Anywhere Access to View and Approve Invoices

In a manual process, reviewing and approving invoices can take days and include many different approvers. Waiting on approvals slows down the payment process, which could lead to late payments.

And the level of difficulty multiplies if you’re not in the office.

With AP automation, you don’t have to be in a specific place to approve invoices and make payments. All you need is internet access, and you can view and approve from your phone or laptop.

3. You Can Create Customized, Automated Workflows

AP automation allows you to create custom workflows with both rules and restrictions. These eliminate the hassle of constantly reaching out to different individuals for approvals every month and provide you with control and visibility over the process.

And in case someone is out of the office or unable to work, your AP team can reroute approvals, so business continues as usual. As an added benefit, all historical actions and comments are recorded, so the new approver can step in without missing a beat or a detail.

4. Sophisticated Reports Are Just A Few Clicks Away

In a manual process, the AP department would spend a lot of time pulling piles of paper out of file cabinets to get an overall picture of the company’s finances.

Fortunately, AP automation simplifies the process by providing comprehensive search and reporting tools. This makes it quicker and easier to gain data to make strategic business decisions when you’re under pressure and don’t have access to usual resources.

5. Electronic Payments Provide Easy Paper Check Alternatives

If you’re still leveraging paper checks as a payment form, you may run into trouble during times of crisis. However, with solutions that provide e-payment options, you can continue paying suppliers even in times where person-to-person delivery of physical checks isn’t feasible.

6. Service Teams Can Help Improve Your Supplier Relationships

The best automation solutions combine dedicated service teams along with software to take on the tedious tasks of keeping up with supplier payment preferences.

And in today’s environment, this becomes especially appealing. You’ll have a trusted AP ally who will continue to maintain contact with your suppliers to see how, if at all, their acceptance conditions are evolving, making sure they are receiving your payments and processing them.

Looking to Bolster Your Own Business Continuity Plan?

If you’ve experienced some of these challenges firsthand, it’s not too late to start building, implementing or strengthening your own business continuity plan.

You can get a head start by asking yourself the five critical questions laid out in our latest e-book, Identifying Gaps in Preparedness: How to Bolster Your Business Continuity Plan.

And if AP automation already sounds like a good fit for your company, we’d love to chat about how we can help. Schedule a demo or learn more about their solutions today!