My wife was recently notified by our wireless provider that her smartphone will no longer be supported. A couple of years ago, when she needed a new cell phone, we made the decision to save some money by buying an older, but not obsolete, model phone. “There’s no reason to spend all that extra money for the latest, greatest model when this one will work just fine,” we reasoned.

Most of us as consumers can relate to this story. Things seem to be changing faster than ever. My teenage children cannot believe that when they were born, we had to take pictures of them using actual cameras because none of us yet had smartphones with built-in cameras. How many movie plots would fall completely apart in a world like today in which smartphones are so ubiquitous?

But are things changing faster than ever? Without question!

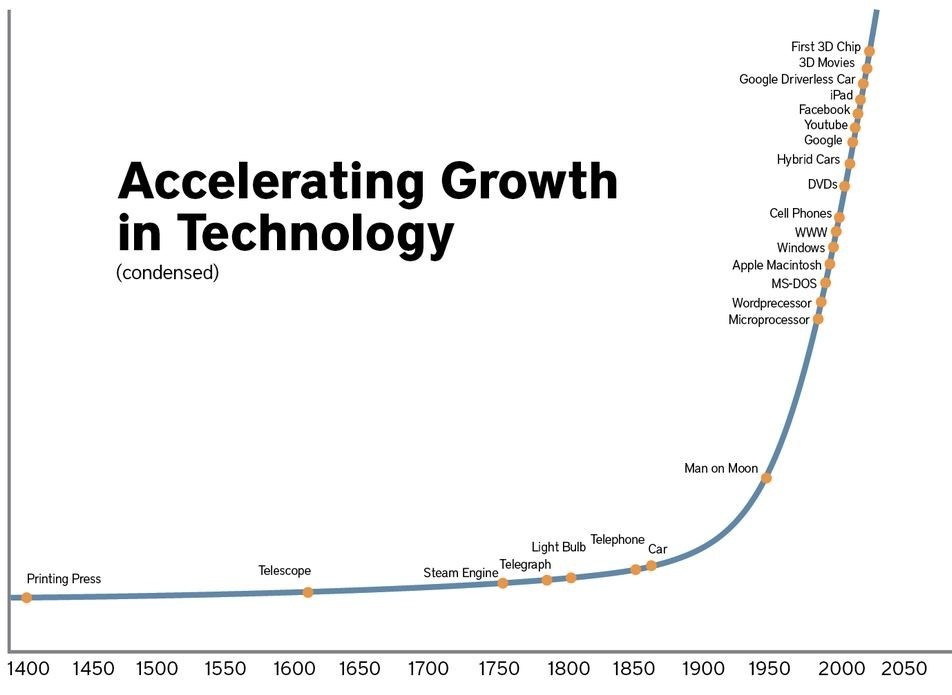

In fact, the speed of technological advancement is said to be exponential, not linear. One scholar, Ray Kurzweil, refers to the phenomenon as“The Law of Accelerating Returns”.

The graphic here displays the advancements of technology on a historical timeline:

Source: Asgard Human Venture Capital for Artificial Intelligence

The idea of keeping pace with this speed of technological change is daunting to any of us individually, but even more so to a nonprofit organization. As a firm that has worked exclusively with nonprofits for nearly three decades, JMT knows that nonprofit organizations tend to lag behind the technology adaptation curve. This lag results in part from simple resource constraints, but primarily from the ‘Overhead Myth’, or the false conception that financial ratios are the sole indicator of nonprofit performance.

This mindset essentially boils down to the idea that as much money as possible should be spent on programs, not infrastructure. The noble intention behind the ideal of that statement was taken to the extreme and became insidious in the nonprofit culture, to the point that there was an almost palpable fear of spending money on anything that is not direct program activity. There has been an organized effort by thought leaders, such as Guide Star, and even foundations who fund nonprofits, such as Virginia G. Piper Charitable Trust, for several years to change the mindset and the culture of nonprofits with regard to infrastructure spending. We believe the lag in technology adaptation by nonprofits is shrinking, though there will always be at least some gap.

The combination of the exponential speed of technological evolution and the gap in nonprofit adaptation creates a risk that falls under the category of the ‘nonprofit starvation cycle’, which is discussed in detail by JMT’s friends at BDO LLP in this benchmarking survey. The ability to grow and serve more people is constrained by a lack of infrastructure spending. Paradoxically, the very outcome nonprofits are trying to avoid —less impact on the community– by spending too much on “overhead” becomes the reality when too little is spent on infrastructure!

While my wife and I are merely annoyed that we spent money on dated technology and are now facing the need to buy a new cell phone, it could be disastrous for a nonprofit to make the same mistake with a mission critical system such as a financial management/ERP or a Donor Management system.

I just returned from a technology conference in which it was announced that an ERP system will be using machine learning to automatically scan the general ledger for anomalies and irregularities in journal entries. I’m sure that this amazing feature will one day be something we all assume is part of any ERP, just as we all assume a cell phone has a camera. Don’t be fooled by solutions with recognizable brand names and years in the marketplace—many of them are powered by older generations of technology. It still works, but how long before those solutions will be obsolete and outdated like my wife’s smartphone?

We’d love the opportunity to learn more about your technology needs and how we can help support your organization’s growth and ability to serve others. To chat with one of our nonprofit experts, contact us here.