This blog post was written by Sage Director of Industry Marketing Nonprofit, Joan Benson, and originally appeared on the Sage Intacct blog.

Nonprofit organizations are frequently adjusting their goals and priorities to meet changing societal and financial trends. Working with small budgets and lean staffing, nonprofits often don’t have the resources needed to truly innovate through technology. Enter Artificial Intelligence (AI) and its potential to enhance nonprofit operations like financial management. As computing has become more efficient and cost-effective as a whole, technology solutions like AI-powered financial management software are no longer constrained by computing power or capacity.

According to the Brookings Institute, nonprofit organizations are increasingly interested in the capabilities of AI, machine learning, and data analytics. In terms of nonprofit financial management, these technologies provide the power to audit every transaction, analyze massive data sets in real-time, and meet processing requirements during periods of uneven demand.

It’s not just about process automation anymore; AI has the potential to revolutionize nonprofit finance. Learn more about how AI is being used to continuously monitor performance and security, detect anomalies or irregular transactions in real-time, and eliminate the close. Discover how AI is helping accelerate time to actionable insights and speed time to revenue.

During the Sage Intacct Nonprofit Finance Leaders Forum, Aaron Harris provided a sneak peek into the future of AI in nonprofit accounting. Harris is Sage’s Chief Technology Officer and is responsible for Sage’s technology and product vision. A pioneer in cloud computing, Harris helped build the world’s first cloud architecture delivering on-demand financial applications with Sage Intacct.

Watch a replay of Aaron Harris’ entire session, AI and the Future of Nonprofit Financial Management, and six other virtual events at the Nonprofit Finance Leaders Forum.

Working with a digital AI assistant

Working with a digital AI assistant is different from using an AI chatbot. Chatbots are typically used as an interface to exchange basic information while digital assistants help provide continuous monitoring and assistance to humans. For example, digital assistants provide meeting reminders and take notes. In financial management software, a digital assistant can apply trend lines to your financial data to drive forecasts.

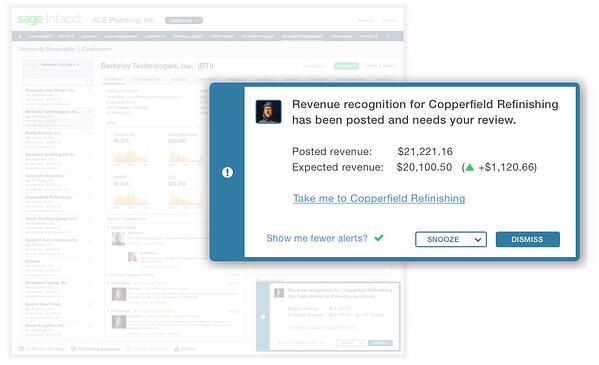

Sage Intacct uses a digital assistant to provide a conversational interface and act as an extension of the nonprofit finance team. It works in the background to monitor performance, detect irregular transactions, and watch for unusual activity or unauthorized access. When the digital assistant finds something abnormal, it notifies the appropriate user via alert messages so the item can be reviewed. The digital assistant can also be used in corporate communication tools to assist employees who don’t usually work directly with Sage Intacct to speed processes such as purchase order approvals or expense report submissions.

If revenue is recorded in an unusual way, a digital assistant can alert you to take a closer look. In some cases, the assistant may also provide you with a list of recommended action.

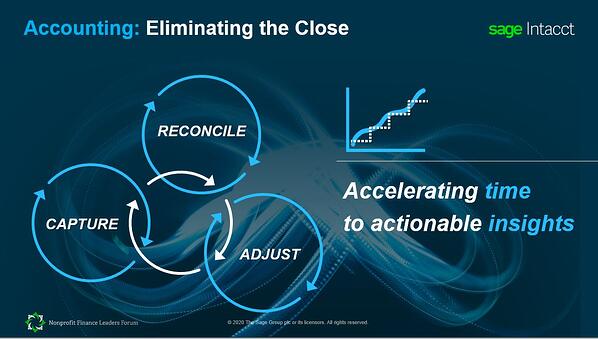

How AI will eliminate the financial close

For several years, it’s been an objective for financial management and accounting software vendors to eliminate the financial close. In order to make this happen, financial management software must be able to continuously capture transactions in real time, reconcile what’s captured in accounting versus external sources, and make adjustments or apply accounting treatments to transactions as information changes.

Speeding time to actionable insights

Automating data entry is one important aspect needed to minimize delays in financial processes. AI can be used to ensure the quick and easy capture of physical documents, such as receipts and bills, needed for Accounts Payable and Accounts Receivable to take action. Employees can simply take a picture with a mobile phone or scan and submit a PDF file and then AI within the system extracts relevant data from the file, categorizes, posts, and reconciles the information in the accounting software.

Leveraging AI to accelerate time to revenue

Time capture is vital to the accurate and timely invoicing of customers. If time capture is not timely, it can negatively affect cash flow, overall revenue, and customer satisfaction. With AI technology like Sage Intelligent Time, you can automatically create timesheets for employees as they work. AI pays attention to your workday by looking at your calendar and use of productivity applications and then groups that work into blocks of time. AI can automatically allocate those blocks of time to a client, project, or specific task. Alternatively, an employee can manually drag and drop blocks of time to the appropriate allocation. Over time, AI will learn that rule for future time block allocations.

Additionally, employees who are remote can use any device to record time and submit timesheets in one click to the accounting system for billing. AI minimizes the need for manual data entry by providing suggestions for time allocation and emboldens employees to review each entry for accuracy before submitting the final timesheet.

By ensuring all types of transactions are captured continuously, AI enables continuous accounting. Your books are always up-to-date with real-time transaction recording, reconciliation, and adjustments. Potential issues are flagged along the way for action and correction. The system has provided the ability to monitor and analyze performance throughout the financial period—as opposed to finding out what really happened at the end of that period.

89% of CFOs agree that the amount of time spent on financial administration has a negative impact on team productivity. To solve for this about three-quarters of financial decision-makers are driving digital transformation in their organization.

Conclusion

If your nonprofit is looking for ways to reduce the amount of time spent on verifying the past and spend more time on strategic activities like forecasting, AI can help. Using AI enabled financial management systems embolden nonprofits to perform continuous accounting, including quick capture of transactions and time, and store all the details needed for accurate time tracking. Plus, our webinar covers two additional areas of nonprofit financial management that AI is poised to improve: continuous assurance and increased knowledge of the unknowns.

With its ability to drive continuous accounting, continuous assurance, and deeper insights, AI is ready to power the future of financial leadership. For a deeper dive into how AI is going to revolutionize nonprofit financial management, watch the webinar replay—then check out the six other complimentary, educational sessions at the virtual Nonprofit Finance Leaders Forum.

Interested in learning how JMT can help optimize your nonprofit's financial management operations with a solution like Sage Intacct?